Building Long-Term Wealth: Essential Financial Independence Strategies Explained

Building Long-Term Wealth: Essential Financial Independence Strategies Explained

Achieving financial independence and building long-term wealth is a goal many aspire to, but few truly understand the foundational strategies required. It's not just about earning a high salary; it's about smart financial planning, disciplined saving, strategic investing, and consistent effort. This journey towards wealth accumulation empowers you to live life on your own terms, free from financial constraints. Whether you're just starting out or looking to refine your existing financial plan, understanding these essential strategies is paramount.

This guide will break down the core components of building long-term wealth, offering actionable insights to help you navigate the complexities of personal finance and set yourself on a path to lasting financial security.

Key Points:

- Define Clear Financial Goals: Know what you're working towards.

- Prioritize Saving and Budgeting: Make conscious spending decisions.

- Invest Wisely and Consistently: Let your money grow over time.

- Manage Debt Effectively: Minimize financial burdens.

- Continuous Learning and Adaptation: Stay informed about financial markets.

Understanding the Pillars of Long-Term Wealth Creation

Building substantial long-term wealth isn't a matter of luck; it's the result of applying proven financial principles consistently. At its core, financial independence strategies revolve around increasing your net worth over time. This means your assets grow faster than your liabilities, and eventually, your passive income exceeds your living expenses. Let's delve into the fundamental pillars that support this crucial objective.

1. Defining Your Financial Goals and Vision

The first, and arguably most critical, step in building long-term wealth is to clearly define what "wealth" means to you and what you want to achieve. Are you aiming for early retirement, leaving a legacy for your family, or simply achieving peace of mind through financial security? Your goals will dictate your strategies.

- SMART Goals: Ensure your objectives are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of "save more," aim for "save $10,000 for a down payment within two years."

- Visualize Your Future: Imagine your life at financial independence. This mental picture can serve as a powerful motivator during challenging times.

- Document Your Plan: Write down your goals and the steps you'll take to achieve them. This makes them more concrete.

For more guidance on setting effective financial targets, readers can explore related articles on financial goal setting and long-term planning.

2. The Power of Saving and Prudent Budgeting

Saving is the bedrock of wealth accumulation. Without a surplus of income, there's nothing to invest. Developing strong saving habits and understanding where your money goes through budgeting is non-negotiable.

Mastering Your Budget

A budget is not about restriction; it's about intentional spending. It's a roadmap for your money, ensuring it serves your goals.

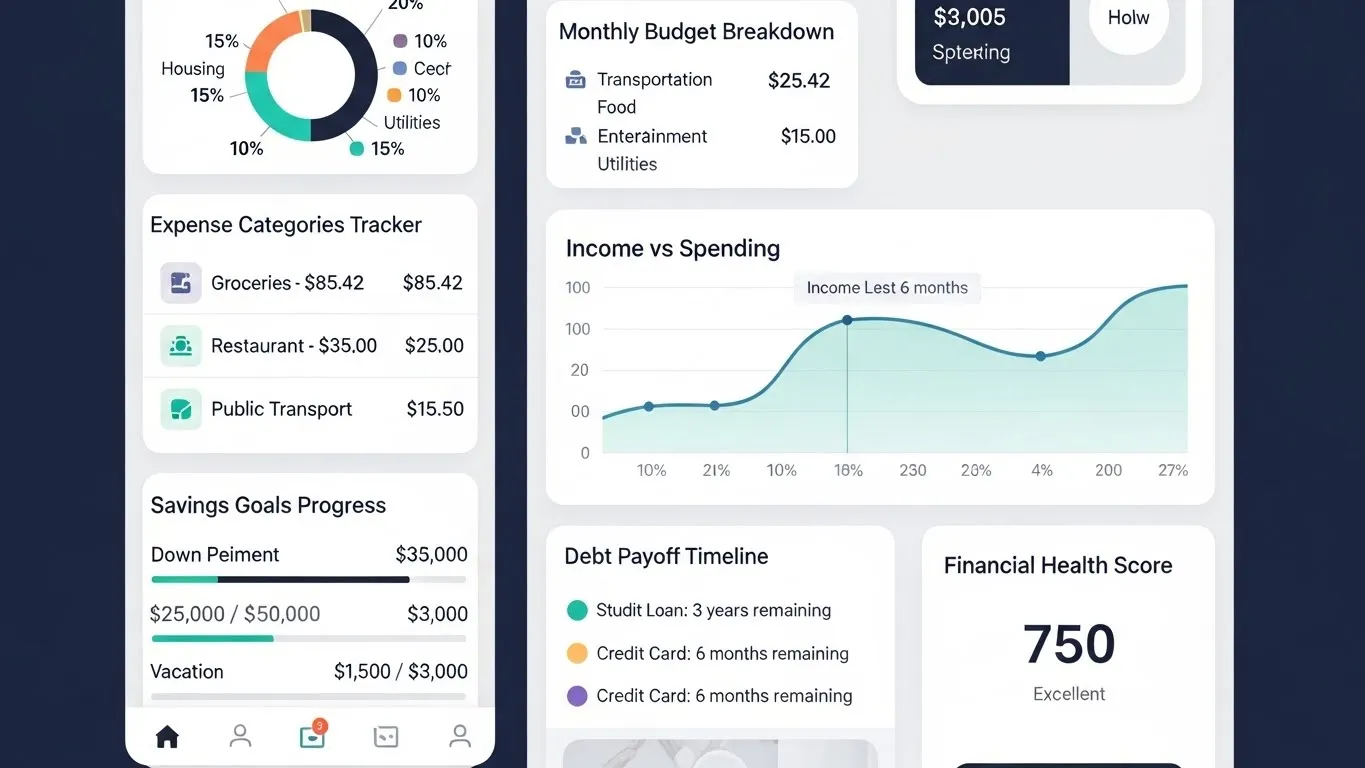

- Track Your Expenses: Use apps, spreadsheets, or a notebook to record every dollar spent. Identify spending patterns.

- Categorize Spending: Differentiate between needs, wants, and savings. Prioritize needs and savings.

- Automate Savings: Set up automatic transfers from your checking to your savings or investment accounts on payday. Treat savings as a non-negotiable bill.

- The 50/30/20 Rule: A popular guideline suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Increasing Your Savings Rate

Consider ways to boost your savings beyond basic budgeting:

- Reduce Unnecessary Expenses: Cut back on subscriptions you don't use, eat out less, or find cheaper alternatives for recurring bills.

- Increase Income: Look for opportunities for raises, side hustles, or freelance work.

- "Pay Yourself First": Make saving an automatic habit before you spend on anything else.

Data from the U.S. Bureau of Labor Statistics in 2023 indicated that households with higher savings rates consistently showed greater net worth accumulation over the long term.

3. Strategic Investing for Long-Term Growth

Saving alone won't make you rich; investing is where your money starts working for you. The magic of compounding—earning returns on your initial investment and on the accumulated interest—is key to significant wealth growth.

Understanding Investment Vehicles

Different investments carry different risks and potential rewards. A diversified portfolio is crucial for managing risk.

- Stocks: Represent ownership in companies. Historically, they have offered higher returns but also higher volatility. For those interested in equity markets, understanding how to research individual stocks or diversify through ETFs and mutual funds is vital.

- Bonds: Represent loans to governments or corporations. They are generally less volatile than stocks and provide a steady income stream.

- Real Estate: Can provide rental income and appreciation, but requires significant capital and management.

- Mutual Funds and Exchange-Traded Funds (ETFs): These pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. They are excellent tools for diversification and professional management.

The Importance of Diversification

Don't put all your eggs in one basket. Diversifying across different asset classes (stocks, bonds, real estate) and within those classes (different industries, geographic locations) reduces overall portfolio risk.

Investing for the Long Haul

- Time in the Market: It's more important than timing the market. Starting early and investing consistently allows compounding to work its magic.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of market conditions, helps reduce the risk of buying at a peak.

- Rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation, selling assets that have grown significantly and buying those that have lagged.

A report by Vanguard in early 2024 highlighted that investors who remained invested through market downturns and continued their systematic investments saw significantly better long-term outcomes than those who tried to time the market.

4. Effective Debt Management

High-interest debt can be a significant drain on your wealth-building efforts. Prioritizing debt repayment, especially for credit cards and personal loans, is essential.

- Understand Your Debt: List all your debts, their interest rates, and minimum payments.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first (the "debt avalanche" method). This saves you the most money in interest over time.

- Consider Debt Consolidation: For some, consolidating multiple debts into a single loan with a lower interest rate can simplify payments and save money.

- Avoid New Debt: Be mindful of taking on new loans or credit card balances that can derail your progress.

For detailed strategies on managing different types of debt, readers can explore related articles on debt reduction and credit management.

5. Continuous Learning and Adaptability

The financial landscape is constantly evolving. Building long-term wealth requires a commitment to continuous learning and adapting your strategies as needed.

- Stay Informed: Read reputable financial news, books, and follow industry experts.

- Understand Economic Trends: Keep abreast of inflation, interest rates, and market performance.

- Review and Adjust: Periodically review your financial plan, goals, and investments. Life circumstances change, and so should your plan.

- Seek Professional Advice: Don't hesitate to consult with a qualified financial advisor, especially as your wealth grows and your financial situation becomes more complex.

Differentiated Value: The Rise of Robo-Advisors and ESG Investing

In recent years, two trends have significantly influenced wealth building:

- Robo-Advisors: These automated investment platforms offer algorithmic-driven portfolio management at a lower cost than traditional human advisors. They are ideal for beginners and those seeking a hands-off approach to investing, leveraging technology to build and rebalance diversified portfolios based on individual risk tolerance and goals. This democratizes access to sophisticated investment strategies.

- Environmental, Social, and Governance (ESG) Investing: Increasingly, investors are aligning their portfolios with their values. ESG investing considers a company's environmental impact, social responsibility, and corporate governance practices alongside financial returns. This trend reflects a growing awareness that sustainable businesses can also be profitable long-term investments, offering a way to build wealth while contributing to positive societal change.

E-E-A-T in Action: Personal Insights on Wealth Building

From personal experience, the most impactful strategy I've adopted is the "set it and forget it" approach to investing, combined with rigorous expense tracking. I initially felt the urge to constantly check market fluctuations, which only led to anxiety and impulsive decisions. By automating my investments into low-cost index funds and only reviewing my portfolio quarterly, I’ve significantly reduced stress and allowed compounding to do its work. For instance, maintaining a consistent 15% savings rate for the last decade, even when my income was modest, has been more effective than sporadic attempts to "time the market." This data-driven approach, focusing on consistent action over market speculation, has been crucial for my long-term wealth journey.

Frequently Asked Questions (FAQ)

Q1: What is the single most important step to start building long-term wealth? A1: The single most important step is to clearly define your financial goals and create a realistic budget. Without knowing what you're working towards and where your money is going, it's impossible to make effective saving and investment decisions for long-term wealth.

Q2: How much money should I aim to save each month for wealth building? A2: A common guideline is to save at least 15-20% of your income. However, the ideal amount depends on your income, expenses, and specific goals. Start with what you can manage and gradually increase it as your financial situation improves.

Q3: Is it better to pay off debt or invest if I have both credit card debt and savings? A3: Generally, it's advisable to pay off high-interest debt, like credit cards (often 15%+ APR), before investing heavily. The guaranteed return from saving on high interest payments usually outweighs the potential returns from investing, especially in the short to medium term.

Q4: How often should I review my investment portfolio? A4: For most individuals, reviewing your investment portfolio once or twice a year is sufficient. Frequent checking can lead to emotional decisions. Focus on your long-term strategy and let compounding work its magic.

Conclusion: Your Path to Lasting Financial Independence

Building long-term wealth is a marathon, not a sprint. It requires discipline, patience, and a strategic approach to managing your finances. By prioritizing saving, investing wisely, managing debt effectively, and committing to continuous learning, you can pave your way to financial independence and achieve your most ambitious financial dreams. Remember, the journey begins with a single step. Start today by implementing one of these essential strategies.

What are your biggest challenges in building long-term wealth? Share your thoughts and questions in the comments below!

For readers interested in deepening their understanding, consider exploring related topics such as advanced investment strategies, tax-efficient wealth accumulation, and estate planning for future generations. These areas offer further insights into optimizing your financial future.