Making Smart Money Decisions for Lasting Financial Success

Making smart money decisions is the bedrock of achieving lasting financial success. In today's dynamic economic landscape, understanding how to manage your finances effectively isn't just a good idea; it's essential for security, freedom, and achieving your long-term goals. This guide delves into the core principles and actionable strategies that empower you to take control of your financial future. By implementing these practices, you can build a robust financial foundation that supports your aspirations and provides peace of mind.

This article will equip you with the knowledge to navigate your financial journey with confidence. We'll explore how informed choices today can pave the way for a more prosperous tomorrow.

Key Points:

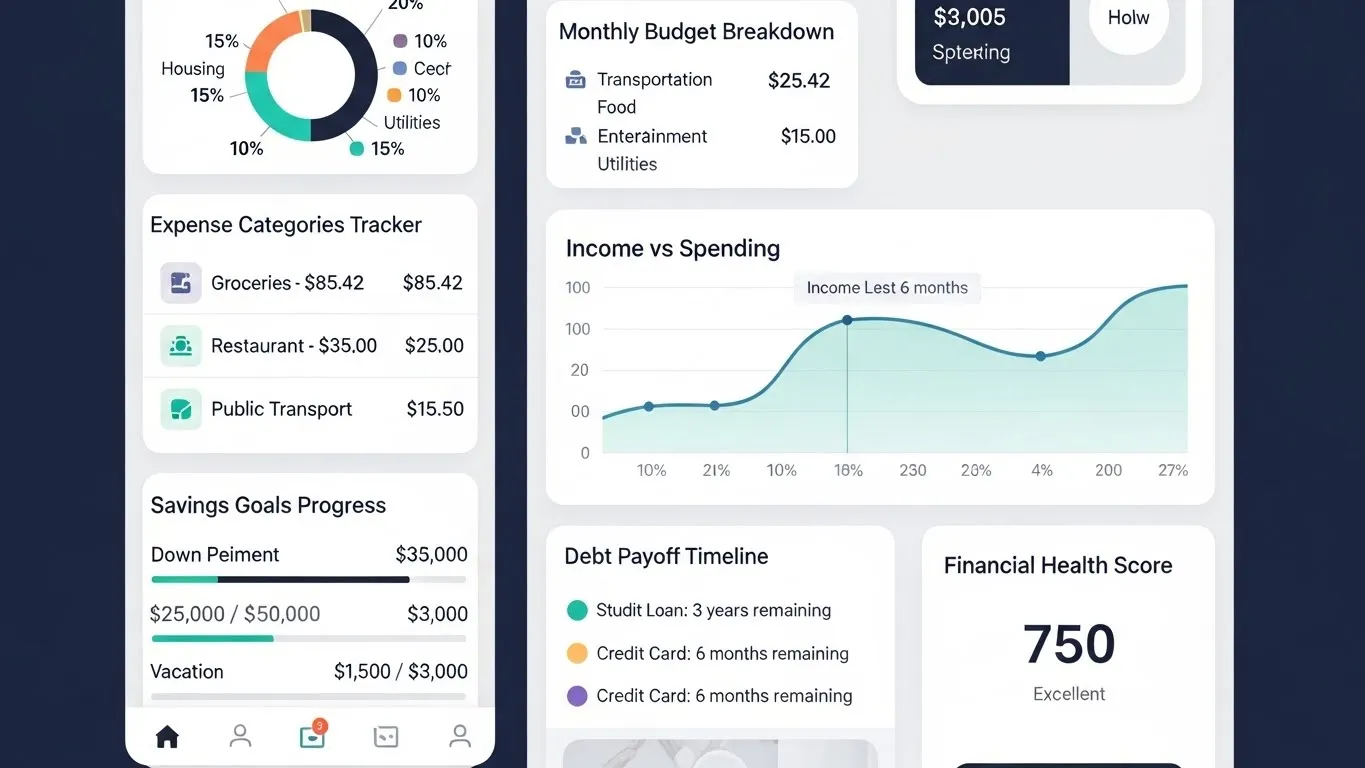

- Budgeting: Understand where your money goes.

- Saving: Build an emergency fund and save for goals.

- Investing: Grow your wealth for the long term.

- Debt Management: Control and reduce financial obligations.

- Continuous Learning: Stay informed about financial trends.

Building a Foundation: Understanding Your Financial Landscape

The first step toward making smart money decisions for lasting financial success is to gain a comprehensive understanding of your current financial situation. This involves a deep dive into your income, expenses, assets, and liabilities. Without this clarity, any financial plan is built on shaky ground. Think of it as a doctor needing to understand your vital signs before prescribing treatment.

Tracking Your Income and Expenses

- Know Your Inflows: Accurately identify all sources of income, including salary, freelance work, investment dividends, and any other financial inflows. This forms the basis of your financial capacity.

- Categorize Your Outflows: Diligently track where your money goes. Categorize expenses into fixed (rent, mortgage, loan payments) and variable (groceries, entertainment, utilities). This is crucial for identifying areas where you can potentially cut back.

- Use Tools: Numerous budgeting apps and spreadsheet templates can help automate this process, making it easier to visualize your spending patterns.

Creating a Realistic Budget

A budget is not a restrictive straitjacket; it's a roadmap for your money. A well-crafted budget allows you to allocate funds purposefully towards your goals while ensuring your needs are met.

- The 50/30/20 Rule: A popular budgeting method suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust these percentages to fit your unique circumstances.

- Zero-Based Budgeting: Assign every dollar of income a job, whether it's spending, saving, or debt repayment. This method ensures maximum control over your finances.

- Regular Review: Your financial life isn't static. Review and adjust your budget monthly or quarterly to reflect changes in income, expenses, or financial goals.

The Power of Saving: Security and Future Growth

Saving money is a cornerstone of financial stability. It provides a safety net for unexpected events and fuels your ability to pursue larger financial aspirations. Making smart money decisions inherently involves prioritizing saving.

Establishing an Emergency Fund

An emergency fund is your first line of defense against financial shocks like job loss, medical emergencies, or unexpected home repairs.

- Target Amount: Aim to save 3-6 months of essential living expenses. Some experts recommend up to 12 months, especially for those with less stable income.

- Accessibility: Keep your emergency fund in a liquid, easily accessible account, such as a high-yield savings account, separate from your daily checking account.

- Replenishment: If you use a portion of your emergency fund, make replenishing it a priority before directing funds elsewhere.

Saving for Short-Term and Long-Term Goals

Beyond emergencies, saving is vital for achieving both immediate desires and future milestones.

- Short-Term Goals: Think about a down payment for a car, a vacation, or a new piece of technology. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals for these.

- Long-Term Goals: These include saving for retirement, a child's education, or a significant purchase like a home. These require consistent, disciplined saving over extended periods.

- Automated Savings: Set up automatic transfers from your checking account to your savings accounts on payday. This "set it and forget it" approach ensures consistent progress.

Investing Wisely for Lasting Financial Success

Once your emergency fund is established and you're consistently saving, it's time to make your money work for you through investing. Investing allows your wealth to grow beyond inflation and can be a powerful engine for achieving long-term financial independence. Making smart money decisions in investing requires patience, research, and a long-term perspective.

Understanding Investment Options

The world of investing is vast. It's crucial to understand the basic asset classes and their associated risks and potential returns.

- Stocks: Represent ownership in a company. They offer potential for high growth but also come with higher volatility.

- Bonds: Essentially loans to governments or corporations. They are generally less volatile than stocks and provide regular income.

- Mutual Funds and ETFs (Exchange-Traded Funds): These are diversified portfolios of stocks, bonds, or other assets. They offer instant diversification, reducing risk.

- Real Estate: Can provide rental income and appreciation, but requires significant capital and management.

- Cryptocurrencies: A newer asset class characterized by high volatility and potential for significant returns, alongside substantial risk. Source: Grayscale Research, "The Digital Asset Investment Landscape" (2024). It's crucial to approach cryptocurrency investments with a thorough understanding of blockchain technology and market dynamics.

Developing an Investment Strategy

A sound investment strategy is tailored to your individual risk tolerance, financial goals, and time horizon.

- Risk Tolerance: How much volatility can you stomach? Younger investors with a longer time horizon might opt for more aggressive, higher-risk investments, while those nearing retirement may prefer more conservative options.

- Diversification: Don't put all your eggs in one basket. Spread your investments across different asset classes and sectors to mitigate risk.

- Long-Term Perspective: The stock market fluctuates. Avoid making impulsive decisions based on short-term market movements. A consistent, long-term approach typically yields better results. Based on historical market data from Vanguard, showing consistent growth over decades.

- Regular Rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation.

Differentiated Value: The Rise of Digital Assets and Financial Literacy

In recent years, digital assets like cryptocurrencies have emerged as a new frontier for investment. While offering unique opportunities, they also present distinct risks and require a specialized understanding. For lasting financial success, incorporating financial literacy about these emerging markets is crucial, even if direct investment isn't pursued. Understanding the underlying technology and market forces can inform broader financial decision-making. For instance, the decentralized nature of some digital assets has spurred discussions about financial inclusion and alternative monetary systems, insights that can enrich one's overall financial perspective.

Mastering Debt: A Critical Component of Financial Health

High-interest debt can be a significant drag on your financial progress, eating away at your income and hindering your ability to save and invest. Making smart money decisions means actively managing and reducing debt.

Understanding Good vs. Bad Debt

Not all debt is created equal.

- Good Debt: Typically, debt taken on for appreciating assets or to improve earning potential (e.g., a mortgage on a home that increases in value, student loans for a degree leading to higher income) can be considered "good debt."

- Bad Debt: High-interest debt, such as credit card balances or payday loans, that do not provide a return on investment and steadily erode your financial health is "bad debt."

Strategies for Debt Reduction

- Debt Snowball Method: Pay off your smallest debts first while making minimum payments on others. Once the smallest is paid off, add that payment to the next smallest debt. This provides psychological wins.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first, while making minimum payments on others. This method saves you the most money on interest over time. Source: Consumer Financial Protection Bureau, "Managing Your Debt" (2023).

- Debt Consolidation: Consider consolidating multiple high-interest debts into a single loan with a lower interest rate, if available and beneficial.

- Avoid New Debt: Be highly disciplined about taking on new "bad debt." Before making a purchase on credit, ask yourself if it's truly necessary and if you can afford the repayment.

Continuous Learning and Adaptation

The financial world is constantly evolving. Staying informed and adapting your strategies are crucial for long-term financial success. Making smart money decisions is an ongoing process, not a one-time event.

Staying Informed About Financial Trends

- Read Reputable Sources: Follow financial news outlets, read books on personal finance, and subscribe to newsletters from trusted financial institutions.

- Understand Economic Indicators: Keep an eye on inflation rates, interest rate changes, and employment figures, as these can impact your financial decisions.

- Educate Yourself on New Technologies: As seen with cryptocurrencies, new financial technologies and investment vehicles emerge. Taking the time to understand them, even if you don't invest, is beneficial.

Seeking Professional Advice

For complex financial situations or significant life events, consulting with a qualified financial advisor can be invaluable. They can provide personalized guidance and help you create a comprehensive financial plan. Ensure you choose an advisor who is a fiduciary, meaning they are legally obligated to act in your best interest.

Conclusion: Your Path to Lasting Financial Success

Making smart money decisions is a journey that requires diligence, patience, and a commitment to continuous learning. By establishing a solid budget, prioritizing saving, investing wisely, managing debt effectively, and staying informed, you can build a secure and prosperous financial future. The principles outlined here offer a framework for achieving lasting financial success, empowering you to live with greater security and freedom.

What are your biggest financial challenges? Share your thoughts in the comments below!

Frequently Asked Questions

Q1: How often should I review my budget? A1: It's recommended to review your budget at least once a month. This allows you to track your spending, identify any discrepancies, and make necessary adjustments as your income or expenses change, ensuring you stay on track with your financial goals.

Q2: What's the safest way to start investing? A2: The safest way to start investing is by diversifying your portfolio across low-cost index funds or ETFs that track broad market indexes. This provides instant diversification and reduces risk compared to investing in individual stocks. Starting with a small, consistent amount is also advisable.

Q3: Is it better to pay off debt or invest? A3: Generally, if the interest rate on your debt is higher than the expected return on your investments, it's often financially smarter to prioritize paying off that debt first. For example, high-interest credit card debt should usually be addressed before aggressive investing.

Q4: How can I avoid impulse spending? A4: To avoid impulse spending, try implementing a waiting period before making non-essential purchases, create a shopping list and stick to it, and unsubscribe from marketing emails that tempt you. Keeping your emergency fund visible can also serve as a reminder of your financial priorities.

Ready to take the next step? Start by tracking your expenses for one week. Then, explore resources on long-term investing strategies. Don't forget to subscribe to our newsletter for more tips on navigating your financial journey and making smart money decisions for lasting financial success.

For further reading, explore articles on retirement planning strategies and the benefits of index fund investing.