Retirement Planning Made Simple: Secure Your Future with Smart Strategies

Embarking on retirement planning can feel like navigating a complex maze, but it doesn't have to be. The dream of a comfortable and secure retirement is achievable with a straightforward approach and the implementation of smart strategies. This guide simplifies the process, breaking down essential steps and offering actionable advice to help you build a robust financial foundation for your golden years.

This article will equip you with the knowledge to confidently plan for retirement, even if you're starting from scratch. We'll cover everything from setting realistic goals to understanding investment vehicles and the importance of regular review.

Key Points:

- Define Your Retirement Vision: Visualize your ideal retirement lifestyle to set clear financial goals.

- Understand Your Financial Landscape: Assess your current savings, debts, and projected expenses.

- Maximize Retirement Savings: Leverage tax-advantaged accounts and employer-sponsored plans.

- Strategic Investment Approach: Diversify your portfolio for growth and risk management.

- Regular Review and Adjustment: Periodically reassess your plan as life circumstances change.

Retirement Planning Made Simple: Your Roadmap to a Secure Future

Setting the Stage: Defining Your Retirement Goals

The first, and perhaps most crucial, step in retirement planning made simple is to define what retirement means to you. This isn't just about outliving your money; it's about living your desired lifestyle. Do you envision traveling the world, pursuing hobbies, spending more time with family, or starting a new venture? Each vision carries different financial implications.

For instance, a retirement filled with frequent international travel will require a significantly larger nest egg than one focused on local activities and gardening. It's beneficial to create a detailed picture, considering:

- Desired Age of Retirement: When do you realistically want to stop working?

- Lifestyle Expectations: What daily activities, hobbies, and travel plans do you envision?

- Location: Will you stay put, downsize, or relocate to a different state or country?

- Healthcare Needs: Anticipate potential medical expenses, including long-term care.

Understanding these elements will help you quantify your financial needs, moving beyond vague aspirations to concrete targets. Researching average costs for your desired lifestyle is a great starting point. For example, data from the Bureau of Labor Statistics often provides insights into retirement spending patterns across different demographics and lifestyle choices.

Assessing Your Current Financial Health

Before charting a course, you need to know your starting point. A thorough assessment of your current financial situation is essential for secure your future with smart strategies. This involves a clear-eyed look at your income, expenses, assets, and liabilities.

- Income Sources: Detail all current income streams, including salary, side hustles, or any passive income.

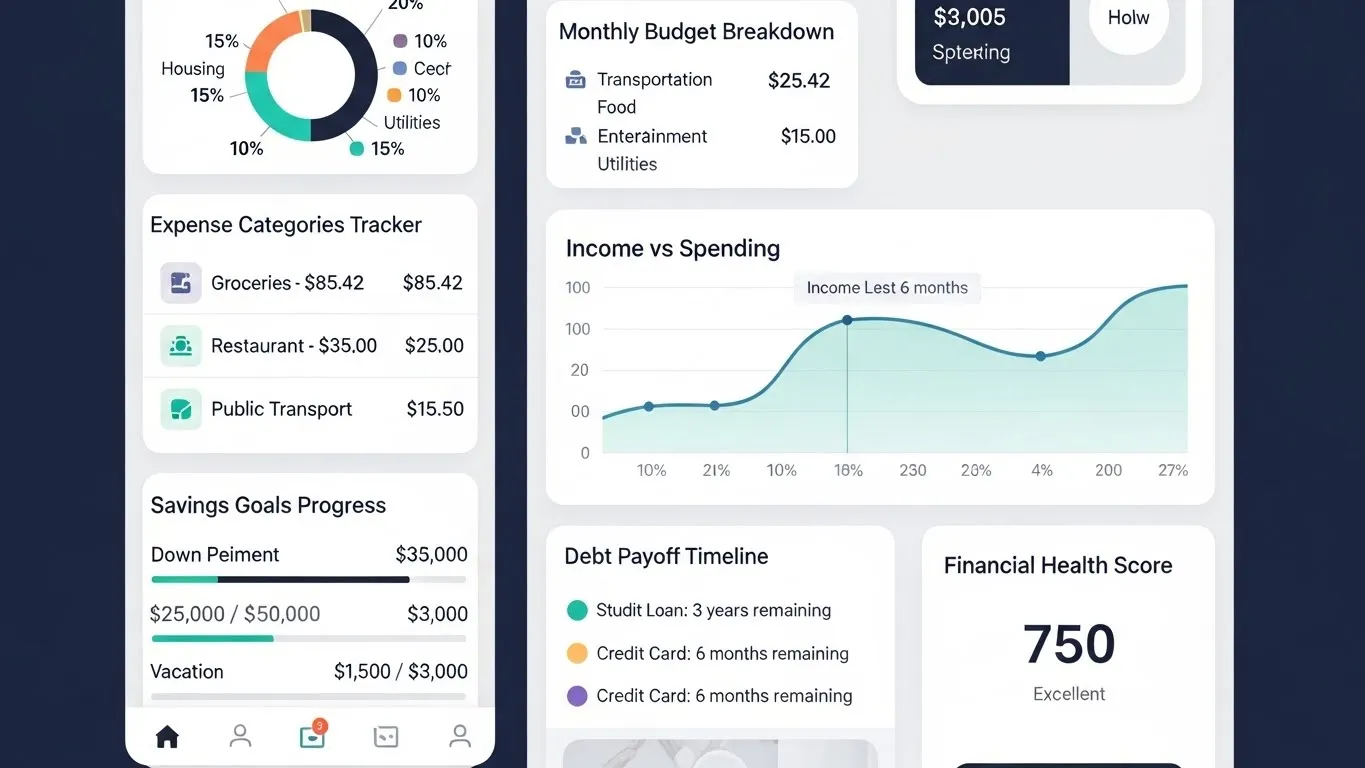

- Expenses: Track your spending diligently for a few months to understand where your money goes. Categorize expenses into essentials (housing, food, utilities) and discretionary (entertainment, dining out).

- Assets: List all your assets, such as savings accounts, investment portfolios, real estate, and any other valuable possessions.

- Liabilities: Document all your debts, including mortgages, car loans, credit card balances, and student loans.

Calculating your net worth (Assets - Liabilities) provides a snapshot of your financial standing. This exercise helps identify areas where you might need to cut back on spending or boost income to accelerate your savings. Many financial experts, including those at AARP, emphasize that knowing your numbers is fundamental to effective financial planning.

Maximizing Your Retirement Savings: The Power of Compounding

One of the most potent tools in retirement planning made simple is the power of compound interest. This is where your earnings start to generate their own earnings, leading to exponential growth over time. The earlier you start saving, the more time compounding has to work its magic.

Several avenues exist for maximizing retirement savings:

- Employer-Sponsored Retirement Plans (e.g., 401(k), 403(b)): If your employer offers a plan, especially with a matching contribution, take full advantage. An employer match is essentially free money, significantly boosting your savings rate. Aim to contribute at least enough to get the full match.

- Individual Retirement Arrangements (IRAs):

- Traditional IRA: Contributions may be tax-deductible in the year they are made, with taxes paid upon withdrawal in retirement.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. This can be particularly advantageous if you expect to be in a higher tax bracket in retirement.

- Catch-Up Contributions: If you are age 50 or older, most retirement plans allow you to make additional "catch-up" contributions, enabling you to supercharge your savings in your later working years.

It's vital to understand the contribution limits and tax implications of each account type. For instance, Fidelity Investments regularly publishes up-to-date contribution limits for various retirement accounts, which are essential for maximizing your tax benefits.

Strategic Investment for Retirement Growth

Simply saving money isn't enough; you need to invest it wisely to outpace inflation and grow your wealth. A well-diversified investment portfolio is key to secure your future with smart strategies. Diversification means spreading your investments across different asset classes to reduce risk.

- Asset Allocation: This refers to how you divide your investment capital among different asset categories, such as stocks, bonds, and cash. The optimal asset allocation depends on your risk tolerance, time horizon, and financial goals. Younger investors with a longer time horizon might opt for a higher allocation to stocks, which historically offer greater growth potential but also higher volatility. As retirement approaches, a shift towards more conservative assets like bonds may be prudent.

- Stocks (Equities): Represent ownership in companies. They offer potential for high growth but come with greater risk.

- Bonds (Fixed Income): Essentially loans you make to governments or corporations. They are generally less volatile than stocks and provide regular income.

- Real Estate: Can offer diversification and potential appreciation and rental income, though it's less liquid than stocks or bonds.

- Mutual Funds and ETFs: These are popular investment vehicles that allow you to invest in a diversified basket of stocks, bonds, or other assets with a single purchase. They are managed by professionals and offer an accessible way to achieve diversification.

A key principle here is portfolio diversification. Never put all your eggs in one basket. For example, the Vanguard Group's research consistently highlights the benefits of broad market index funds for long-term investors seeking diversification and low costs.

Differentiated Value: Embracing the "Gig Economy" for Retirement

As the traditional career path evolves, so too must retirement planning. For many, the "gig economy" offers not just flexibility but also a unique opportunity to supplement retirement income or even build a retirement nest egg while still employed.

Unique Insight: Many retirement planning resources focus solely on traditional employment savings. However, for those engaging in freelance work, consulting, or side hustles, a specific strategy is needed.

- Self-Employed Retirement Plans: If you are self-employed or a small business owner, explore plans like Solo 401(k)s or SEP IRAs. These plans often allow for much higher contribution limits than traditional IRAs.

- Tax Implications of Gig Income: Understand how to manage taxes on freelance income. Setting aside a portion for taxes and understanding deductible business expenses can significantly impact your net earnings available for saving.

- Building a "Retirement Gig": Consider how your skills could translate into part-time, remote work in retirement. This not only provides income but also mental stimulation and social connection. A 2024 report by the National Institute on Retirement Security indicated a growing trend of individuals planning to work longer or in part-time roles during their retirement years.

Staying on Track: Regular Review and Adaptation

The journey to a secure retirement is not a set-it-and-forget-it endeavor. Life is dynamic, and so are financial markets. Regularly reviewing and adjusting your retirement plan is non-negotiable for retirement planning made simple.

- Annual Financial Check-up: Treat your retirement plan like an annual physical. Review your progress, check if you're on track with your savings goals, and rebalance your investment portfolio if necessary.

- Life Events: Major life events – marriage, divorce, the birth of a child, inheritance, job loss, or significant health changes – can all impact your retirement plan and necessitate adjustments.

- Market Fluctuations: While you shouldn't panic sell during market downturns, understanding how volatility affects your portfolio and making strategic rebalancing decisions is crucial.

It's also important to stay informed about changes in retirement legislation and tax laws. Staying proactive ensures your plan remains aligned with your goals and the external financial environment.

Authoritative Sources for Further Insight:

- U.S. Securities and Exchange Commission (SEC): The SEC provides investor education materials, including guidance on retirement savings and investment choices, with publications updated frequently.

- The Employee Benefit Research Institute (EBRI): EBRI conducts extensive research on retirement savings and security, publishing data and analysis regularly, with their 2025 reports highlighting concerning trends in retirement readiness for certain demographics.

- The IRS (Internal Revenue Service): The IRS website is the definitive source for information on contribution limits, tax implications, and rules surrounding retirement accounts, with annual updates to contribution maximums.

Frequently Asked Questions About Retirement Planning

Q1: How much money do I really need to retire comfortably? A1: While there's no single magic number, a common guideline is to aim for 80% of your pre-retirement income. However, this varies greatly depending on your lifestyle. Consider your expected expenses, healthcare costs, and desired activities. Using retirement calculators can provide a more personalized estimate based on your specific circumstances.

Q2: When is the best time to start retirement planning? A2: The absolute best time to start is now, regardless of your age. The sooner you begin saving and investing, the more time compound growth has to work for you. Even small, consistent contributions made early on can make a significant difference over the long term.

Q3: Should I focus on saving more or investing more aggressively for retirement? A3: Both saving more and investing strategically are crucial. Prioritize saving enough to take advantage of any employer match. Then, focus on investing your savings in a diversified portfolio aligned with your risk tolerance and time horizon. Increasing your savings rate, even by a small percentage annually, can have a substantial impact.

Q4: What are the biggest mistakes people make in retirement planning? A4: Common mistakes include starting too late, not saving enough, underestimating healthcare costs, not investing wisely (or investing too aggressively/conservatively), and failing to adjust the plan over time. Another significant error is failing to account for inflation's impact on purchasing power.

Conclusion: Take Control of Your Retirement Future

Retirement planning made simple isn't about complex financial jargon; it's about taking consistent, informed steps toward a secure future. By defining your vision, understanding your finances, maximizing savings, investing wisely, and regularly reviewing your plan, you can build the confidence and financial security needed for a fulfilling retirement.

The strategies discussed today are designed to empower you to take control of your financial destiny. Don't let the perceived complexity deter you. Start with one small step today, and build from there.

What are your biggest retirement planning questions? Share them in the comments below! If you found this guide helpful, please share it with friends and family who are also looking to secure their future. For more in-depth advice on portfolio diversification, readers can explore related articles on asset allocation strategies.

Expand Your Knowledge:

- The Impact of Inflation on Retirement Savings

- Understanding Different Types of Annuities for Retirement Income

- Estate Planning Basics for Retirees